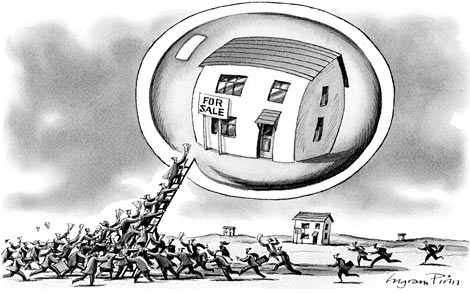

Housing Bubble About To Burst?

Written by: on

The issue of housing and household debt is prominent in the media at the moment. Warning signs of a crash in the housing industry are accompanied by some pretty staggering statistics and predictions.

For example, in the Weekend Australian (6-7 April 2017) Adam Creighton wrote a piece titled "If The Housing Bubble Bursts, Our Entire Economy Will Crash"!

He said that excluding resource exports, greater than 20% of Australia's economic growth in the last four years related to home building and there are 600,000 jobs in home building all up. Each new home built gives rise to consumption growth, provided the home is sold of course. Sold they are, but often to speculators or developers with investment in property at a three year high.

Foreign buyers make up over 20% of the housing sales in Victoria and NSW.

The housing market is highly concentrated with Sydney and Melbourne making up more than 50% of the market. Despite the continued demand for housing from working people who have to borrow heavily to purchase one, investment analysts such as Jonathon Tepper from UK says the bubble is about to burst with home approvals having peaked in early 2015 and still falling.

He asks, "Could Australian home values be a mirage?" with house prices in Sydney and Melbourne having risen 100% since 2008.

How have people been able to buy houses over this period when it is also no secret that wages and salaries as a percentage of GDP have declined?

Where does the money come from? From what the capitalist press is saying, it is largely due to people borrowing amounts of money for inflated house prices that they cannot afford, courtesy of the banks and other financial sharks.

Australian household debt is rising three times as fast as wages and has been doing so for nearly a decade and is now over 190% of GDP.

Most of Australians' wealth is tied up in housing directly and also through shares in the very banks to whom people are in debt!

One staggering figure from the Australian article is that 40% of the $1.65 trillion in mortgages outstanding is in interest alone!

In the 1980s, business loans made up more than 67% of loans from banks.

In 2016, business loans are less than 33% of the $2.67 trillion of outstanding loans.

Now the prices of housing in the dominant markets of Sydney and Melbourne are beyond most young working class homebuyers and those that do buy are taking ever higher risks of not being able to pay off their house payments.

Job losses and reduction in family income through reduced working hours or irregularity of work add to the brewing problem. The loss of full time jobs over the last four years and growth in more precarious jobs with respect to hours of work is still the dominant trend, despite the last two months seeing the highest number of new full time jobs in over 25 years.

This latter statistical information from the ABS is a misleading because it includes full time casual work which is not guaranteed work even in a capitalist economics sense. The figures also include labour hire jobs created by companies and governments outsourcing work. These jobs register as new jobs as their employer (the labour hire company) records an increase in its workforce!

How Super Is Super?

This question was asked when the employer-paid superannuation scheme was brought in to awards in the late 1980s in lieu of a wage increase.

Ever since its inception there has been a struggle between the industry run funds on behalf of workers and the big end of town who want to get their hands on the accumulated funds worth trillions of dollars now.

The latest idea of young people being able to divert employer-paid superannuation payments in to an account to be used as a deposit on a new home is really a transfer of workers’ money to the financial institution issuing the loan for the purchase of the home. It is yet another transfer of wealth from the workers to finance capital, a desperate move to try and keep the capitalist system growing which is its modus operandi.

You would think that the housing industry and banks would support Sally McManus and the ACTU push to lift the minimum award wage towards 60% of the median wage. The minimum award wage is currently a historic low of 44% of the minimum wage. Some may support it, seeing that an increase in wages will entice more to keep an interest in buying a home. However other sections of the capitalist class including the Business Council of Australia are outraged at a $45 increase to the minimum weekly wage and think the increase should be less than 2%.

Whatever they do, it is unlikely the competing sections of the capitalist ruling class can prevent a crash in the housing market and the catastrophe for families immediately affected by it.

Perhaps they know it, the same as Trump knows he cannot provide the thousands of blue collar jobs he promised to 'make America great again'. Perhaps that what is what the talk and growing practice of war is all about.

Their last resort to breathe life in to a moribund system is to force the people on to a war footing.

Print Version - new window Email article

-----

Go back

Independence from Imperialism

People's Rights & Liberties

Community and Environment

Marxism Today

International

Articles

| On the introduction of supermarket security checkpoints |

| WOMAD: Marley to perform, Palestinian musicians banned |

| International Women’s Day lifts struggle for liberation of women and socialism! |

| ICOR Call for International Women’s Day |

| We support the international campaign to free Ecevit Piroğlu |

| Workers’ power and closing the loopholes industrial laws |

| Sovereignty, a message to whitefellas |

| When whitefellas dance Ceremony, it’s time for consequences |

| RIghts Of Indigenous Peoples’ Struggles Continue As Governments Side With The Big End Of Town |

| Community school mural censored over First Nations artist's identity with Palestinians |

| Miko Peled speaks truth about the Zionist war against Palestine |

| #FreeDanDuggan - A Fight for Freedom and Australian Sovereignty |

| Mr Mundine, stop harming kids if you want them to go to school! |

| Opposition to Zionism is not anti-Semitism. |

| How Secure Are Australia's Defence Bases? |

| Corporate management and the Alliance for Responsible Citizenship |

| Imperialism and the Israeli state condemned Palestinians to poverty. |

| Microsoft buys into AUKUS and Australian surveillance industry |

| After the referendum, we cannot fight blindly |

| Dan Duggan - a shameful anniversary |

-----