Budget exposes myth of falling profitability and productivity

Written by: (Contributed) on 18 May 2023

(Source: Andy Pucko on Creative Commons Flickr)

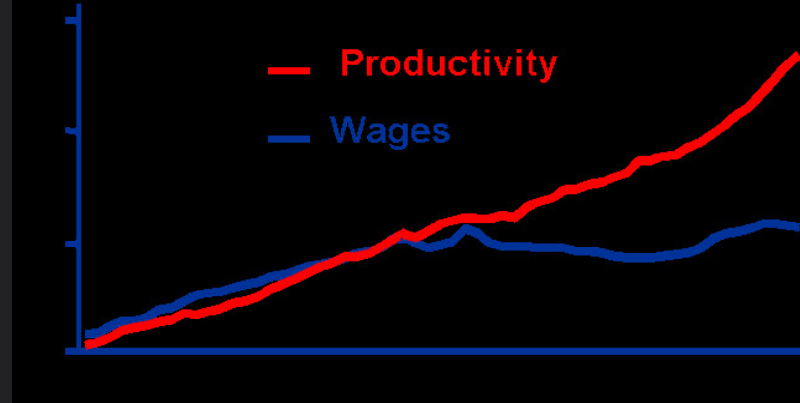

The 2023 Australian federal budget has a myriad of figures and technical detail amongst which are some that give the lie to claims of falling profitability and productivity.

In fact, if measured against the ability of companies to remain profitable in the face of regional competition from low-wage economies where millions of workers earn a few dollars a day, the Australian working class must rate amongst the most profitable and productive in the world. Here are current and projected figures as calculated from Budget projections:

COMPANY TAX RECEIPTS (1)

|

Year |

Amount Paid ($bn) |

Increase on 2021-22 |

% increase on 2021-22 |

|

2021-22 |

123.3 |

||

|

2022-23 |

138.4 |

15.1 |

12.25% |

|

2023-24 |

167.7 |

29.3 |

21.17% |

|

2022-23 to 2026-27 |

190.2 |

51.8 |

37.43% |

In conclusion, the years of low-wage settlements for workers, cost-cutting and the race-to-the-bottom mentality of imperialist globalisation has systematically lowered the standard of living for the Australian working class. The business model is also in acceleration, with ever increasing returns for capitalists: widespread casualisation has been used to systematically undermine trade-unions with industrial relations. Even their own statistics, from inside the corridors of power and the Australian Tax Office, the facts show the outcome of present-day employer's industrial relations techniques and lies about failing profitability and productivity.

For the record, Australian has a workforce of approximately 13 million, with a two-thirds participation rate reducing the figure to 8.5 million, of which well over a million are holders of temporary work visas.

Those in the latter category are particularly vulnerable to exploitation by employers, as a recent test case in Sydney revealed with a sponsored skilled worker on a 457 visa. (2) A federal court imposed $291,000 in penalties and back-payment orders on the owners of a Sydney hairdressing salon for exploiting a South Korean hairdresser. Over a four-year period, from 2015 to 2019, the worker was underpaid $49,000 and also required to repay $105,000 of wages and entitlements to the salon owner. The court also imposed a $100,000 penalty against the employer. The legal hearing included the worker stating they had not asked questions of their employer as they did not want to jeopardise their working opportunities in Australia, which, it would appear, is commonplace among temporary visa holders.

The recent Australian Company Tax Receipts presented above, furthermore, should be viewed in the context of rampant tax avoidance procedures and 'creative accounting techniques', whereby companies only pay the bare minimum of what is expected. Multi-nations, based in Australia, for example, can use other countries as 'tax havens' by shifting their main assets elsewhere.

The true figure, relating to the productivity of the Australian working-class, is likely to be much higher!

1. Tax bonanza but slower growth ahead, Australian Business Review, 10 May 2023.

2. Hairdresser ordered to pay worker $291k, Australian, 14 April 2023.

Print Version - new window Email article

-----

Go back

Class Struggle and Socialism

Independence from Imperialism

People's Rights & Liberties

Community and Environment

Marxism Today

International

Independence from Imperialism

People's Rights & Liberties

Community and Environment

Marxism Today

International

Articles

| Honour the Past, Fight for the Future |

| Swissport CEO shows contempt for workers |

| ACOSS survey and the need for a revolutionary class analysis |

| Rail workers strike for a living wage |

| Profits before People |

| Ants and Elephants: Middle Class relations with the Imperialist Bourgeoisie and the Working class |

| Aged Care Workers Win Higher Wages and Some Respect |

| Party Anniversary and Congress |

| Rising Tide Lifts All Boats |

| Closing loopholes or creating new ones? |

| The Factors of Production in Contemporary Australia |

| Pilbara Train Drivers Take industrial Action Against BHP |

| Book review - Missing the point: Alison Pennington's "Gen F'D" |

| Bosses still out to undermine Awards in changing workforce |

| Strength In Diversity - The Australian Working Class |

| Call to support US Auto Workers' Strike |

| When Workers Unite, Bosses Tremble! |

| Wage thieves don’t like new legislation |

| Working together "for the nation" is a class question |

| Trickle-down economics: double standards, rigged rules |

-----